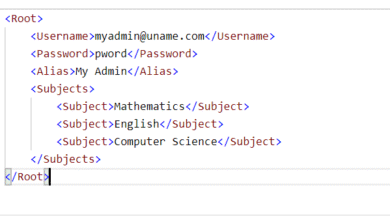

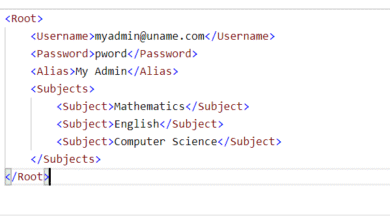

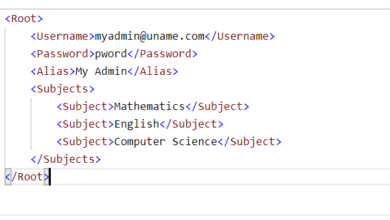

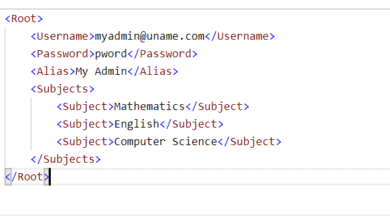

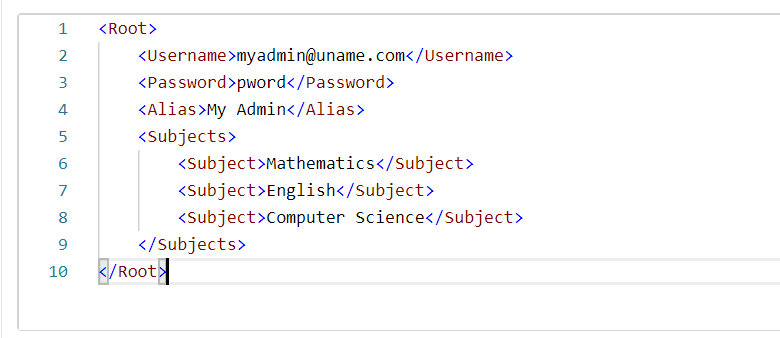

import_all_aljz.xml

Trump sues JPMorgan and CEO Dimon over alleged ‘debanking’

United States President Donald Trump has sued banking giant JPMorgan Chase and its CEO Jamie Dimon for $5bn, accusing JPMorgan of debanking him and his businesses for political reasons after he left office in January 2021.

The lawsuit was filed on Thursday in Miami-Dade County court in Florida. It alleges that JPMorgan abruptly closed multiple accounts in February 2021 with just 60 days’ notice and no explanation. By doing so, Trump claims JPMorgan cut the president and his businesses off from millions of dollars, disrupted their operations and forced Trump and the businesses to urgently open bank accounts elsewhere.

“JPMC debanked [Trump and his businesses] because it believed that the political tide at the moment favored doing so,” the lawsuit alleges.

In a statement, JPMorgan said that it “regrets” that Trump sued them but insisted they did not close the accounts for political reasons.

“We believe the suit has no merit,” a bank spokesperson said. “JPMC does not close accounts for political or religious reasons. We do close accounts because they create legal or regulatory risk for the company.”

The White House said it will refer the matter to the president’s outside counsel.

Banks have faced growing political pressure in recent years, particularly from conservatives who argue that lenders have improperly adopted “woke” political positions and, in some cases, discriminated against certain industries, such as firearms and fossil fuels.

That pressure has intensified during Trump’s second term, with the Republican president claiming in interviews that some banks refused to provide services to him and other conservatives. The banks have denied the allegation.

A US banking regulator said last month that the nine largest US banks in the past had placed restrictions on providing financial services to some controversial industries in a practice commonly described as “debanking”.

Last year, JPMorgan said it was cooperating with inquiries from government agencies and other entities regarding its policies and procedures in light of the Trump administration’s push to scrutinise banks over alleged debanking.

Reputational risk

US regulators have examined themselves to see if overly strict supervisory policies discouraged banks from providing services to certain sectors.

Trump-led officials have also moved to loosen oversight, with federal bank regulators last year saying they would stop policing banks based on so-called “reputational risk”.

Under that approach, supervisors could penalise institutions for activities that were not explicitly prohibited but could expose them to negative publicity or costly litigation.

Banks have increasingly complained that the reputational risk standard is vague and subjective, giving supervisors wide discretion to discourage firms from providing services to certain people or industries.

The industry has also argued that regulators need to update anti-money laundering rules, which can force banks to close suspicious accounts without giving customers an explanation.

Paramount Skydance extends Warner Bros takeover bid offer

![Paramount Skydance has repeatedly pursued a hostile takeover bid of Warner Bros. Discovery as its deal with Netflix looms [File: Mike Blake/Reuters]](https://www.aljazeera.com/wp-content/uploads/2026/01/2026-01-22T131001Z_264531435_RC2I0JAF57S4_RTRMADP_3_WARNER-BROS-DISCOVERY-M-A-PARAMOUNT-SKYDAN-1769110402.jpg?resize=770%2C513&quality=80)

Paramount Skydance has extended the deadline for its hostile tender offer for Warner Bros Discovery by a month, buying time to persuade investors that its bid is superior to one from Netflix.

The Ellison-owned media company on Thursday moved the deadline to February 20 to consider its $77.9bn offer to buy Warner shares for $30 apiece in cash. The bid has a total enterprise value of more than $108bn, including debt.

The extension marks the second time Paramount has pushed out the deadline since challenging Warner’s merger agreement with Netflix last month.

Earlier this month, Warner’s board rejected an amended Paramount bid that included $40bn in equity personally guaranteed by Larry Ellison, Oracle’s co-founder and father of Paramount CEO David Ellison. Larry Ellison is also a close ally of US President Donald Trump.

As of late Wednesday, Paramount said more than 168.5 million Warner shares had been tendered in support of its offer. That remains far below the 50 percent threshold needed to gain control of the company, which has about 2.48 billion shares outstanding in its Series A common stock.

“Once again, Paramount continues to make the same offer our Board has repeatedly and unanimously rejected in favor of a superior merger agreement with Netflix,” Warner said in an emailed statement on Thursday, adding that it is “clear our shareholders agree”, as more than 93 percent have so far rejected “Paramount’s inferior scheme”.

In December, Netflix agreed to buy Warner’s studio and streaming business for $72bn. This week, it switched its offer from a cash and stock combination to an all-cash deal that the companies say is more straightforward and will speed the path to a shareholder vote by April. Including debt, the enterprise value of that deal is about $83bn, or $27.75 per share.

Paramount, however, argues its offer is better and has accused Warner’s leadership of a lack of transparency with shareholders.

On Thursday, the company said Warner’s board was “rushing to solicit shareholder approval” for the Netflix merger, warning that debt from a previously announced spinoff of Warner’s networks business could reduce the eventual payout to shareholders.

The battle for Warner is complicated by the fact that Netflix and Paramount are seeking different assets.

A successful deal would reshape Hollywood by handing control of franchises from Friends to Batman, along with the HBO Max streaming service, to a single buyer.

Netflix deal lingers

Netflix’s bid covers only Warner’s studio and streaming business, including HBO Max and its TV and film production arms. Paramount’s offer, by contrast, is for the entire company, including its news and cable operations, potentially putting CNN under the same roof as CBS.

If Netflix prevails, Warner’s networks would be spun off into a separate company called Discovery Global under a previously announced plan.

A sale of Warner Bros Discovery is expected to be lengthy and face intense antitrust scrutiny. Politics are likely to play a role under Trump, who has made unprecedented suggestions about his personal involvement in the approval process.

The Ellisons have argued that their relationship with Trump gives them an easier regulatory path. Netflix co-CEO Ted Sarandos said on a post-earnings call on Tuesday that the company has made progress toward securing the necessary approvals.

On Wall Street, Paramount Skydance is up 1.9 percent, Warner Bros Discovery is down 0.4 percent. Netflix is tumbling down 2.5 percent in midday trading.

US Supreme Court appears reluctant to let Trump fire Fed’s Lisa Cook

Conservative and liberal United States Supreme Court justices have signalled scepticism towards US President Donald Trump’s bid to fire US Federal Reserve Governor Lisa Cook in a case with the central bank’s independence at stake.

During about two hours of arguments in the case on Wednesday, the justices indicated they were unlikely to grant the Trump administration’s request to lift a judge’s decision barring the Republican president from immediately firing Cook while her legal challenge continues to play out.

Some of the justices pressed D John Sauer, the US solicitor general arguing for Trump’s administration, about why Cook was not given a chance to formally respond to the unproven mortgage fraud allegations – which she has denied – that the president cited as justification for ousting Cook.

They also raised concerns about the effect on the economy of such a first-ever presidential firing from the central bank and the implications for the Fed’s cherished independence from political influence.

The case represents the latest dispute to come to the top US judicial body involving Trump’s expansive view of presidential powers since he returned to office 12 months ago.

When the court, which has a 6-3 conservative majority, agreed in October to hear the case, it left Cook in her job for the time being.

“This case is about whether the Federal Reserve will set key interest rates guided by evidence and independent judgment or will succumb to political pressure,” Cook, who attended the arguments, said in a statement afterward.

“For as long as I serve at the Federal Reserve, I will uphold the principle of political independence in service to the American people,” Cook added.

Federal Reserve Chairman Jerome Powell also sat through the nearly two hours of arguments in the packed courtroom.

‘Cause for removal’

Sauer told the justices that the allegations against Cook impugn her “conduct, fitness, ability or competence to serve as a governor of the Federal Reserve”.

“The American people should not have their interest rates determined by someone who was, at best, grossly negligent in obtaining favourable interest rates for herself,” Sauer said.

“Deceit or gross negligence by a financial regulator in financial transactions is cause for removal,” Sauer added, arguing that the allegations require immediate removal.

Cook has called the allegations against her a pretext to fire her over monetary policy differences as Trump heaps pressure on the central bank to cut interest rates and lashes out at Fed Chair Powell for not doing so more quickly.

Conservative Chief Justice John Roberts asked Sauer to explain whether his argument that Cook should be immediately removed applies if the basis of the mortgage allegations – that she cited two different properties as a principal residence – is an “inadvertent mistake contradicted by other documents in the record”.

Sauer responded that, even if Cook made a mistake on mortgage paper, “it is quite a big mistake”.

Roberts seemed sceptical, telling Sauer, “We can debate that.”

Paul Clement, the lawyer arguing for Cook, told the justices that the allegations against her arise from “at most an inadvertent mistake” on a mortgage application concerning a vacation property.

Trump’s move against Cook is seen as the most consequential challenge to the Fed’s independence since it was formed in 1913. Until now, no president had sought to oust a Fed official.

A Supreme Court ruling is expected by the end of June.

Pressure on Fed independence

Conservative Justice Samuel Alito expressed concern that the administration had handled the case “in a very cursory manner”. Though the case involves Trump’s asserted cause to fire Cook, Alito said, “No court has ever explored those facts. Are the mortgage applications even in the record in this case?”

“There’s a million hard questions in this case,” Alito said.

In creating the Fed, Congress passed a law called the Federal Reserve Act that included provisions meant to insulate the central bank from political interference, requiring governors to be removed by a president only “for cause,” though the law does not define the term nor establish procedures for removal.

Clement told the justices that Trump’s position would transform tenure protections for Fed governors into “at-will employment”.

“That makes no sense,” Clement said. “There’s no rational reason to go through all the trouble of creating this unique, quasi-private entity that is exempt from everything from the [congressional] appropriations process to the civil service laws, just to give it a removal restriction that is as toothless as the president imagines.”

Roberts expressed doubts about Sauer’s arguments that the president’s assertion of a cause is not reviewable, or that judges cannot reinstate a fired officer.

Conservative Justice Brett Kavanaugh expressed doubts about the real-world effects of the administration’s arguments.

“Your position,” Kavanaugh told Sauer, “that there’s no judicial review, no process required, no remedy available, very low bar for cause that the president alone determines – I mean, that would weaken, if not shatter, the independence of the Federal Reserve.”

Conservative Justice Amy Coney Barrett also questioned why the Trump administration has denied Cook a hearing to defend herself, saying that it “would not have been that big of a deal” for Trump to sit down with Cook and lay out the alleged evidence against her.

Barrett also asked Sauer about the practical implications of allowing Trump’s firing of a Fed governor.

“We have amicus [friend-of-the-court] briefs from economists who tell us that if Governor Cook is [fired], that would trigger a recession. How should we think about the public interest in a case like this?” Barrett asked, adding: “If there is a risk [at this preliminary stage of the case], doesn’t that counsel caution on our part?”

Sauer said that Cook was notified in August of her termination, and that has not affected the markets. Sauer urged the justices to weigh the predictions of doom for the US economy by economists in briefs submitted in the case supportive of Cook with a “jaundiced eye”.

US District Judge Jia Cobb in September ruled that Trump’s attempt to remove Cook without notice or a hearing likely violated her right to due process under the US Constitution’s Fifth Amendment. Cobb also found that the mortgage fraud allegations likely were not a legally sufficient cause to remove a Fed governor under the law, noting that the alleged conduct occurred before she served in the Fed post.

The US Court of Appeals for the District of Columbia Circuit declined Trump’s request to put Cobb’s order on hold.

‘You’re fired’

Conservative and liberal justices alike posed sharp questions to Sauer on his contention that Cook was not entitled to formal notice and a hearing before removal by the president.

Conservative Justice Neil Gorsuch asked Sauer what such a hearing would look like and whether Cook would have a right to legal counsel.

Sauer responded that the court in the past has been very reluctant to “dictate procedures to the president” and that it would be up to Trump to decide.

“Calling Ms. Cook into the [White House] Roosevelt Room, sitting across a conference table, listening for, I don’t know how long, how much evidence is a lawyer required, and then making a decision? Could that suffice?” Gorsuch asked, adding: “Just a meeting across a conference table finished with, ‘You’re fired’?”

Conservative Justice Clarence Thomas asked Sauer on what basis the justices should conclude that the Fed is “an executive branch agency and hence that the president does have a removal authority”.

“There’s an academic dispute about whether or not the Federal Reserve’s Open Market operations constitute executive power or something else, essentially private conduct. However, Congress has over the years kind of packed on traditional executive powers on the Federal Reserve,” Sauer replied.

As a Fed governor, Cook helps set US monetary policy with the rest of the central bank’s seven-member board and the heads of the 12 regional Fed banks. Her term in the job runs to 2038. Cook was appointed in 2022 by Democratic former US President Joe Biden and is the first Black woman to serve in the post.

Liberal Justice Ketanji Brown Jackson pressed Sauer to reconcile two seemingly conflicting positions: his claim that the president has broad discretion to remove a Fed governor, and his recognition that Congress included tenure protections for Fed governors to shield the Fed’s independence from White House interference.

“How does that further the aims of the statute?” Jackson asked.

Alito voiced scepticism toward Clement’s argument that a Fed governor’s conduct before taking office cannot provide a basis for removal by the president, asking Cook’s attorney to address a series of increasingly egregious hypothetical scenarios.

“How about if, after the person assumes office, videos are disclosed in which the office holder is expressing deep admiration for Hitler or for the Klan?” Alito asked.

The president sought to fire Cook on August 25 by posting a termination letter on social media citing the mortgage fraud allegations disclosed by Federal Housing Finance Agency Director Bill Pulte, a Trump appointee.

The administration this month opened a criminal investigation into Powell over remarks he made to Congress last year about a Fed building project, a move he similarly called a pretext aimed at gaining influence over monetary policy.

US House panel advances bill to give Congress authority on AI chip exports

![The bill comes after Trump allowed shipments of Nvidia made chips to China [File: Dado Ruvic/Reuters]](https://www.aljazeera.com/wp-content/uploads/2026/01/2026-01-21T130423Z_1703667428_RC2KEGA8U2ZJ_RTRMADP_3_USA-CHINA-CHIPS-1769023675.jpg?resize=770%2C513&quality=80)

The United States House of Representatives Foreign Affairs Committee has overwhelmingly voted to advance a bill that would give Congress more power over artificial intelligence chip exports despite pushback from White House AI tsar David Sacks and a social media campaign against the legislation.

Representative Brian Mast of Florida, a Republican and the chair of the House Foreign Affairs Committee, introduced the “AI Overwatch Act” in December after US President Donald Trump greenlit shipments of Nvidia’s powerful H200 AI chips to China.

The legislation, which still needs to clear the full House and Senate, would give the House Foreign Affairs Committee and the Senate Banking Committee 30 days to review and potentially block licences issued to export advanced AI chips to China and other adversaries.

The bill claims that those “countries of concern” also include countries beyond China, such as Russia, Iran, North Korea, Cuba and Venezuela.

The bill also requires the US Department of Commerce to provide lawmakers with a full, detailed application that shows that the chips will not be used for military, intelligence or surveillance applications conducted by adversarial nations to the US.

One source said the bill’s odds of being passed increased after a coordinated media campaign last week against the bill.

“These advanced chips need to fall under the same oversight as any other military-related system,” Mast said at a session on Wednesday before the committee vote. “This is about the future of military warfare.”

The tech advocacy group, Americans for Responsible Innovation, which has been pushing for the bill, said in a fact sheet that the act will “slow China’s progress in developing AI that could rival US capabilities”.

“America must win the AI arms race,” Mast said in a release when he first introduced the bill late last year.

White House pushback

A spokesperson for Sacks and the White House did not respond to requests for comment.

Last week, Sacks shared a post from an X account called “Wall Street Mav” that claimed the bill was being orchestrated by “Never Trumpers” and former staffers of Presidents Barack Obama and Joe Biden to undermine Trump’s authority and his America First strategy.

The post singled out the CEO of AI firm Anthropic, Dario Amodei, claiming he hired former Biden staffers to push the issue.

“Correct,” Sacks wrote.

An Anthropic spokesperson declined to comment on the claims and the bill. But Amodei has been outspoken about preventing China from getting advanced chips like the H200.

“It would be a big mistake to ship these chips,” Amodei said on Tuesday at the World Economic Forum in Davos, Switzerland. “I think this is crazy. It’s a bit like selling nuclear weapons to North Korea.”

Conservative activist Laura Loomer, among others, also posted on X criticism of the bill last week, calling it “pro-China sabotage disguised as oversight”.

Before the vote, Mast and other committee members rejected the online attacks.

“There are special interest groups out there right now with millions of dollars funded by the very people who will profit off the sale of these chips and others that … are waging a social media campaign war … against this bill, which the chairman is advancing to protect the national security interest of the United States of America,” said Representative Michael McCaul, a Republican congressman from Texas. “Shame on them.”

Nvidia did not respond to requests for comment, nor did the US Commerce Department, which oversees export controls.

‘Rupture in the world order’: What Carney, world leaders said in Davos

US allies unite against Trump’s threats to take over Greenland at Davos

As world leaders, including allies of the United States, gather in the Swiss resort city of Davos for the World Economic Forum (WEF), US President Donald Trump’s attacks on the existing global world order have been on the top of their minds with Canadian Prime Minister Mark Carney saying the US-led global system is enduring “a rupture”.

Trump’s threat to take over Greenland, by force if necessary, has roiled his European allies, who have pushed back against the US president’s policies of using brute force to achieve his foreign policy goals. On January 3, US forces abducted Venezuelan President Nicolas Maduro and took him to the US in a military operation that sent shockwaves across the world.

Trump has threatened to impose new tariffs on European nations if they oppose him on Greenland.

The European Union’s top official called the proposed tariffs a “mistake” while the Canadian prime minister warned that middle powers risk being sidelined if they fail to act together.

Here are the key takeaways of Tuesday’s WEF meetings:

Carney: ‘If you are not at the table, you are on the menu’

Carney said the world’s middle powers must unite to resist coercion by aggressive superpowers, warning that traditional assumptions about global order no longer hold.

“If great powers abandon even the pretence of rules and values for the unhindered pursuit of their power and interests, the gains from transactionalism will become harder to replicate.”

“So we’re engaging broadly, strategically with open eyes,” he said. “We actively take on the world as it is, not wait around for a world we wish to be.”

The Canadian leader dismissed the notion of a global system built around “American hegemony” as a “fiction”, arguing that multilateralism is fading as institutions including the World Trade Organization and the United Nations are “greatly diminished”.

“Canadians know that our old, comfortable assumption that our geography and alliance memberships automatically conferred prosperity and security is no longer valid,” Carney said. “Let me be direct. We are in the midst of a rupture, not a transition.”

“You cannot ‘live within the lie’ of mutual benefit through integration when integration becomes the source of your subordination,” Carney added.

He said “middle powers”, including Canada, must cooperate with one another because “if you are not at the table, you are on the menu.”

“Nostalgia is not a strategy. But we believe that from the fracture, we can build something bigger, better, stronger, more just.”

Turning to Greenland, Carney said:

“Canada strongly opposes tariffs over Greenland and calls for focused talks to achieve our shared objectives of security and prosperity in the Arctic.”

France’s Macron: ‘We prefer respect to bullies’

French President Emmanuel Macron used his speech in Davos to denounce Trump’s threat to impose tariffs to pressure European countries over Greenland.

Macron described the “endless accumulation” of new tariffs as fundamentally unacceptable, “even more so when they are used as leverage against territorial sovereignty”, he said.

Wearing aviator sunglasses during his address, which the Elysee Palace said were to protect his eyes after a burst blood vessel, Macron joked:

“It’s a time of peace, stability and predictability,” prompting laughter from the audience.

He then struck a more serious tone.

“It’s clear we are reaching a time of instability, of imbalances,” the French president continued. “More than 60 wars in 2024, an absolute record, even if I understand a few of them were fixed.”

Macron concluded by outlining his vision for Europe’s role in addressing global challenges:

“We will be committed during 2026 to try to deliver this global agenda in order to fix global imbalances through more cooperations, and we will do our best in order to have a stronger Europe,” he said.

“Here, in the epicentre of this continent, we do believe that we need more growth, we need more stability in this world.”

He called for Europe to strengthen its trade defence instrument while at the same time sought investment, including from China, the world’s second largest economy.

“China is welcome, but what we need is more Chinese foreign direct investments in Europe in some key sectors to contribute to our growth, to transfer some technologies and not just to export towards Europe,” he said.

Speaking about Greenland he said: “We have decided to join a mutual exercise in Greenland without threatening anyone but just supporting an ally and another European country, Denmark.”

He ended his speech by saying: We do prefer respect to bullies. We do prefer science to plotism, and we do prefer rule of law to brutality. You are welcome in Europe, and you are more than welcome to France.”

EU’s Ursula von der Leyen: ‘Nostalgia will not bring back the old order’

European Commission President Ursula von der Leyen said a series of recent geopolitical shocks will force the EU to build a more independent Europe.

“The good news is we acted immediately. Whether on energy or raw materials, defence or digital, we’re moving fast.”

But she cautioned that the EU “will only be able to capitalise on this opportunity if we recognise that this change is permanent”.

“Of course, nostalgia is part of our human story, but nostalgia will not bring back the old order.”

Von der Leyen also said the EU was close to concluding a free trade agreement with India although further work was still needed to finalise the deal.

“We are on the cusp of a historic trade agreement,” she said.

“Some call it the mother of all deals, one that would create a market of 2 billion people accounting for almost a quarter of global GDP.”

Von der Leyen is expected to visit India early next week.

The European Commission president also said the sovereignty and territorial integrity of Denmark and Greenland are nonnegotiable.

“We are working on a package to support Arctic security,” she said, adding that the EU is also preparing a “massive European investment surge in Greenland” to support the local economy and infrastructure.

China’s He: ‘China’s development presents an opportunity’

China’s development is an opportunity rather than a threat, and Beijing is ready to use its market strengths to share growth with other countries, Chinese Vice Premier He Lifeng said at the World Economic Forum.

“China’s development presents an opportunity, not a threat, to the global economy,” He said, adding that disputes and misunderstandings in international trade should be addressed through “equal consultation” to build trust, bridge differences and resolve problems.

He also stressed that China would continue to open up its economy.

“China will open its door still wider to the world,” he said, pledging to align this policy with high-standard international economic and trade rules.

He said China would further foster a market-oriented, law-based and internationalised business environment and ensure equal treatment for domestic and foreign companies.

“We welcome foreign enterprises to continue investing in China and sharing in China’s opportunities,” He said while urging other governments to provide a fair, nondiscriminatory, transparent and predictable investment environment for Chinese businesses.